The Lindy Effect in Marketing: The Slow Death of Better, Faster, Cheaper

What Lasts, What Fades— Betting on Endurance in Marketing and Digital Strategy

In a business landscape obsessed with innovation and disruption, it's easy to forget that durability often signals value. Enter the Lindy Effect—a powerful mental model suggesting that the future life expectancy of certain non-perishable things (like technologies, ideas, books, or business models) is proportional to their current age. Simply put: the longer something has lasted, the longer it's likely to continue lasting.

The concept was first introduced in 1964 by writer Albert Goldman, who observed that the career lifespan of comedians seemed inversely related to how long they’d been performing. He named the theory after Lindy’s, a now-defunct New York deli where comedians gathered after shows to trade war stories and assess each other’s longevity in the spotlight.

Since then, the Lindy Effect has moved well beyond the stage. It’s been formalized by mathematicians and most notably championed by bestselling author and risk analyst Nassim Nicholas Taleb, who redefined it in Antifragile. Taleb views the Lindy Effect as a heuristic for predicting endurance in an uncertain world. The key insight: things that survive longer are more robust—further from what he calls the "absorbing barrier" of failure or extinction.

In practical terms, the Lindy Effect helps investors evaluate which technologies are likely to stick around, guides entrepreneurs in building timeless brands, and reminds executives that what’s proven to last is often more valuable than what’s merely new. In a world addicted to novelty, the Lindy Effect rewards those who bet on time-tested ideas.

"If a book has been in print for forty years, I can expect it to be in print for another forty years. But, and that is the main difference, if it survives another decade, then it will be expected to be in print another fifty years.

"This, simply, as a rule, tells you why things that have been around for a long time are not “aging” like persons, but “aging” in reverse. Every year that passes without extinction doubles the additional life expectancy. This is an indicator of some robustness. The robustness of an item is proportional to its life!"

Cryptocurrencies and the Lindy Effect: Betting on Survival

Cryptocurrencies offer a compelling modern-day example of the Lindy Effect in action. Whether comparing Bitcoin to gold or electric vehicles to gasoline engines, the Lindy framework suggests a valuable rule of thumb: the longer a newcomer survives, the more likely it is to keep surviving.

Each additional year that a disruptive innovation persists—without collapsing or becoming obsolete—adds to its projected longevity. Survival itself becomes a signal of strength. In this sense, time acts as a stress test: fragile ideas die young; robust ones endure.

Nassim Nicholas Taleb frames this elegantly. For living organisms, age diminishes life expectancy—a 70-year-old is expected to live fewer years than a 60-year-old. But for non-perishables like ideas, technologies, or institutions, age does the opposite: the longer they've lasted, the longer they’re expected to last.

Applied to crypto, this means that each additional year Bitcoin remains relevant increases its odds of long-term survival. What was once speculative becomes increasingly durable—not because of any new features, but because of its proven resilience over time.

In markets defined by hype and volatility, the Lindy Effect is a rare filter for clarity.

Background

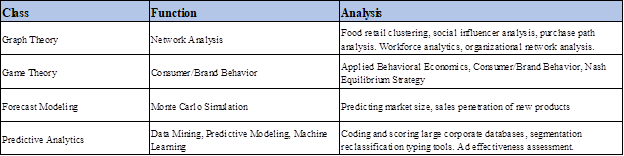

As an undergraduate mathematics major and later a graduate student in statistics and decision theory, I took several advanced courses I never expected to apply in a professional setting. But the unexpected rise of personal computing power—combined with the proliferation of open-source statistical platforms like the R Project for Statistical Computing—has pushed these once-esoteric methods into the marketing research mainstream.

According to the Lindy Effect, methods that have endured for decades are likely to remain relevant for many more. The real challenge today is not developing new tools, but rather mainstreaming the powerful, time-tested ones that already exist.

Below is a partial list of classic and emerging analytical techniques—and the roles they can play in a modern research firm’s toolkit.

The Fragile Side of Innovation: What the Lindy Effect Tells Us About Social Media Strategy

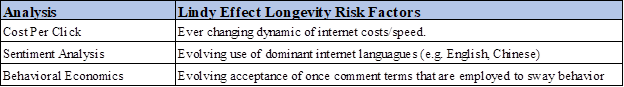

The flip side of the Lindy Effect challenges the staying power of emerging tools and trends—especially in the digital marketing space. In my view, few areas are more vulnerable than social media strategy.

Why? Because, as the Lindy Effect reminds us, enduring innovations—think the wheel or electricity—are built to last. Flashy, fast-moving trends rarely stand the test of time.

Nowhere is this more evident than in the ever-shifting world of social platforms and micro-targeting. The constant churn of algorithms, tactics, and engagement tools makes many of these “sexy” strategies obsolete almost as quickly as they gain traction.

Below is a list of analytical approaches that must continuously evolve to stay relevant—and in doing so, reveal their own fragility.

Another illustration of the fragility of newer analytical frameworks is the Social Media Cone. As defined by ScienceDirect.com, the Social Strategy Cone was designed to evaluate and structure social media strategies. The framework outlines seven core elements that shape effective digital engagement—but like many trend-driven models, its long-term durability remains uncertain.

The Social Media Cone

One of the central issues in evaluating newer technologies is the rapidly shrinking window between Initiation and Obsolescence. The roadways of innovation are littered with once-promising products that failed to endure. Consider, in descending order of speed to irrelevance: the ice box, Gimbels Department Store, the Pet Rock, Radio Shack, Netscape, MySpace, Grooveshark. The pattern is clear—longevity is not guaranteed.

Lifetime Value Analysis Meets the Lindy Effect

As defined by Optimizely, Customer Lifetime Value (LTV) is “an estimate of the average revenue that a customer will generate throughout their lifespan as a customer.” This measure of customer “worth” helps guide critical decisions around marketing budgets, resource allocation, profitability, and forecasting.

At its core, LTV represents the present value of projected future cash flows from a customer relationship. It’s a foundational metric in the marketing analytics community—standard, even.

But how accurate is LTV when applied to social media platforms?

Take Facebook, for example. Can the company reliably estimate the long-term value of a new user?

Technically, yes. The modeling tools—regression analysis, churn prediction, discounting future revenue, margin simulation, and retention cost analysis—are well established.

The real challenge is time—specifically, the time horizon over which the relationship is measured. And this is where the Lindy Effect introduces friction.

As a Baby Boomer, I joined Facebook a decade ago to reconnect with high school classmates, old camp friends, and former coworkers. My daughter, however, sees Facebook as “for old people.” Her generation—and certainly the next—is already moving on.

Instagram may be today’s platform of choice for Millennials and Gen Z. In 2025, users aged 16 to 24 overwhelmingly favored it. But challengers like TikTok—and emerging technologies like AR and VR—are already reshaping the digital landscape.

As Albert Goldman, the originator of the Lindy Effect, might put it: the issue isn’t the methodology. That’s rock solid. The issue is longevity. Without knowing how long platforms like Facebook or Instagram will remain relevant, LTV models rest on uncertain ground.

In a fast-moving, trend-driven environment, the value of a customer is only as durable as the platform that hosts them.

To my students and the next generation of marketing researchers, a word of advice: learn math. Our industry has spent the past two decades chasing the holy grail of better-faster-cheaper. That era, while not gone, is fading. As clients become more sophisticated and demand deeper, more defensible insights, the pendulum is swinging back toward analytical rigor.

The tools of high-quality statistical analysis—once limited to specialists—are now widely available and easier to apply than ever. Mastering these methods isn’t just a technical asset; it’s a career differentiator. Whether you're modeling demand for the next breakthrough product—or, yes, marketing the next Pet Rock—quantitative fluency will set you apart in a field where everyone has opinions, but few have the numbers to back them up.